DI Martin Schmidt

I hold a Master's degree in Financial and Actuarial Mathematics from the Vienna University of Technology (graduation with highest distinction) and have been working as a Quantitative Credit Risk Manager within an international banking group in Austria for more than 4 years. In 2020, I joined the National Bank of Austria as an Examiner for IRB credit risk models of significant financial institutions. I have excellent programming and database (Python, R, SAS, SQL, VBA) as well as statistical/mathematical skills and gained hands-on machine learning experience during various Data Science Hackathons (amongst others: Winner of the ‘Coding Challenge on Risk Management‘ hosted by the European Central Bank).

Curriculum Vitae

Download my latest CV here.

Personal Overview

- Date of birth: December 31, 1992

- Nationality: Austria

- Marital status: married, 1 child

- Military service: completed

- Period of notice: 4 months

Professional Experience

> Examiner - IRB Credit Risk Models (SI) at the National Bank of Austria (September 2020 - ongoing)

- Analysis and validation of methods for assessing credit risk and quantifying default and loss estimates (PD/LGD/CCF)

- Preparation of detailed assessment reports following inspection activities at supervised significant financial institutions

- Acquisition of a profound knowledge of current regulatory standards (CRR, EBA GL on PD & LGD, RTS on AM, ECB Guide to IM)

- Working on automation projects with an emphasis on risk differentiation and model calibration adequacy using R

> Quantitative Credit Risk Manager at ING in Austria (July 2016 - August 2020)

- Development of the first machine-learning (XGBoost) based retail credit decision model for consumer lending in Python within a close agile collaboration with the global Advanced Analytics team, development of a challenger model using traditional statistical methods (Logistic Regression), support of the successful validation of the machine-learning model

- Monitoring of various retail credit decision and behavioral probability of default models working together with the global Model Validation Team, backtesting of external rating models (CRIF, KSV, Credify)

- Responsibility for the implementation of regulatory requirements (International Financial Reporting Standard 9 and risk provisioning, Forbearance, New Definition of Default) in SAS

- Lead for the development of an autonomous automated credit risk reporting solution from internal databases (raw bank data) via SAS/SQL, visual basic for applications and non-personal accounts

- Extensive support of other departments (Collections, Compliance, Finance, Fraud, Non-Financial Risk, Operations) with an emphasis on data analytics and automation

- Member of the local COVID-19-Taskforce, responsible for internal and external payment holiday reporting, simulations on risk weighted assets and risk costs and forecasts of the potential impacted portfolio

- Regular direct reporting to the local Management Board and the local Credit Risk Committee regarding various corporate and retail credit risk topics

View Letter of Reference here.

View Recommendation Letter from the CRO here.

Academic Education

> MSc Financial- and Actuarial Mathematics at Vienna University of Technology (March 2016 - March 2019)

- Graduation with highest distinction (view certificate here)

- Diploma Thesis: Aggregation of Integer-Valued Risks with Copula Induced Dependency Structure (awarded with the AVÖ-price in 2020)

> BSc Financial- and Actuarial Mathematics at Vienna University of Technology (October 2012 - March 2016)

- Bachelor Thesis: Standard Formula for the Calculation of the Solvency Capital Requirement under Solvency II

Special Achievements

> October 2020: Winner of the Advancement Award (issued by the Actuary Association of Austria)

Awarded for the diploma thesis on risk aggregation supervised by Dr. Uwe Schmock within the master studies at the Vienna University of Technology

View certificate here.

> November 2019: Winner of the ECB Coding Challenge on Risk Management (hosted by the European Central Bank)

Part of a small international team (’EUreka!’) working on (dynamic) web-scraping of various news websites and unsupervised machine learning for Natural Language Processing (clustering of similar/related articles using Latent Dirichlet Allocation)

View certificate here.

Presentation of the developed solution (GUI and Clustering):

> May 2019: Winner of the 2nd DSI Data Science Hackathon (hosted by BAWAG Group AG)

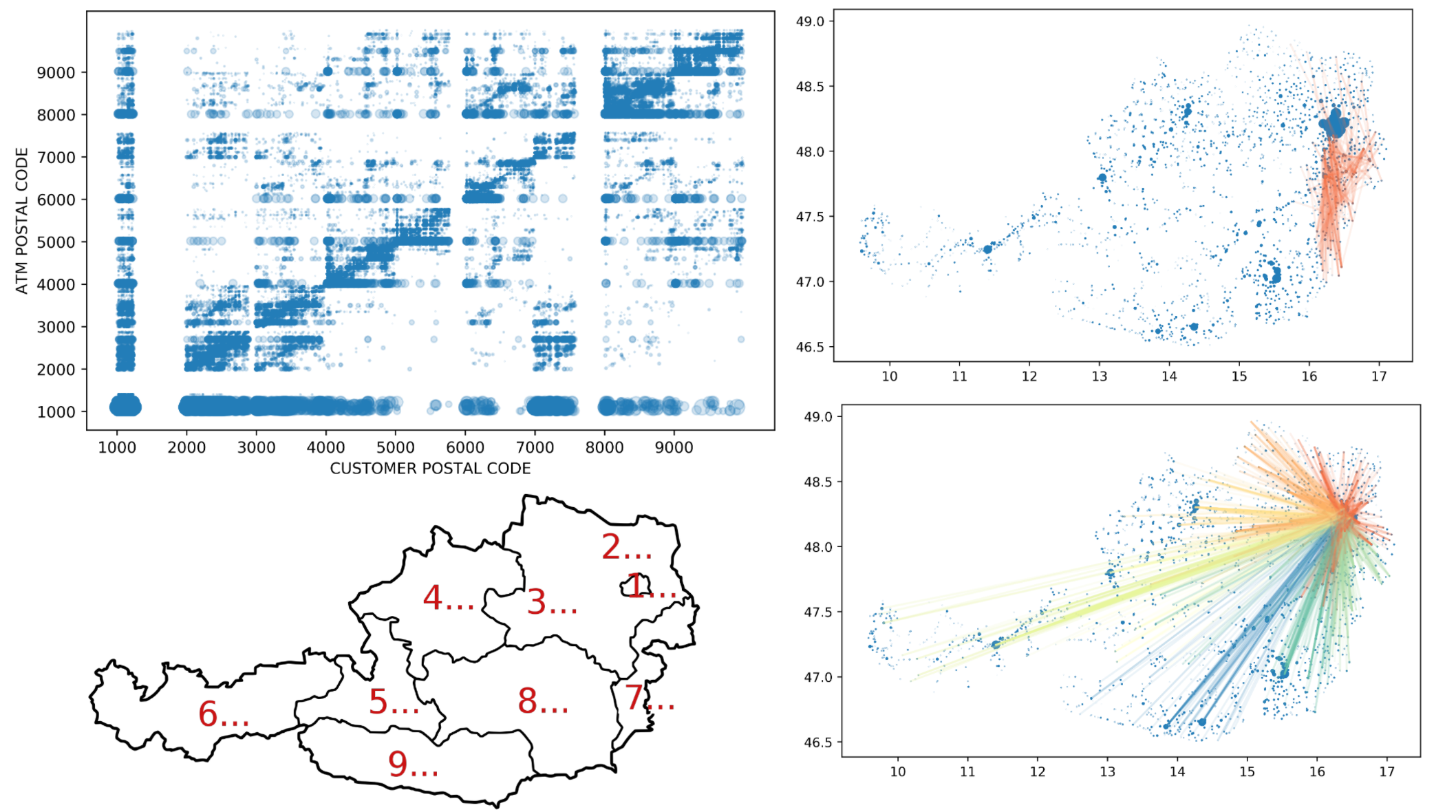

Prediction of age and place of residence of customers from transaction data (ATM withdrawals); visualization of insights (customer mobility, adequacy of location of branches)

- 1st place in ‘Data Insights’

- 2nd place in ‘Model Performance’

Example: Motion profile of customers based on ATM withdrawals

Professional Training

> Financial Risk Management & Modeling

- Development of PD and LGD/EAD models (Risk Research)

- Building better Scorecards (ScorePlus)

- PRM Certification (ongoing, started in July 2019)

- Credit Risk Modeling for Basel/IFRS 9 (BlueCourses, ongoing)

- Statistical methods and data analytics for IRB model examiners (National Bank of Austria)

> Programming and Data Science

- SAS E-Learnings (SAS Programming 1-3, SAS Macro Language 1-2, Predictive Modelling, SQL)

- Programming in C/C++/Matlab/R/VBA (Vienna University of Technology)

- Machine Learning Methods and Data Analytics in Risk and Insurance (Vienna University of Technology)

- Various Data Science online-courses (e.g. DataCamp Data Science Track) using Python and R (ongoing)

IT / Programming Skills

- SAS Base (expert)

- SQL (expert)

- R (advanced)

- Python (advanced)

- VBA (advanced)

- Git (advanced)

- Java (basic)

- C, C++ (basic)

Languages

- German (native language)

- English (business fluent)